Investing in the stock market can be a daunting task, especially for new investors. However, using the right stock market analysis tools can make a significant difference in your investment decisions. These tools provide insights into market trends, company performance, and key metrics that help you make informed choices. In this article, we'll explore some of the best stock market analysis tools and how to use them to enhance your investment strategies.

Stock market analysis tools offer a range of features that help investors stay informed and make data-driven decisions. Some key reasons to use these tools include:

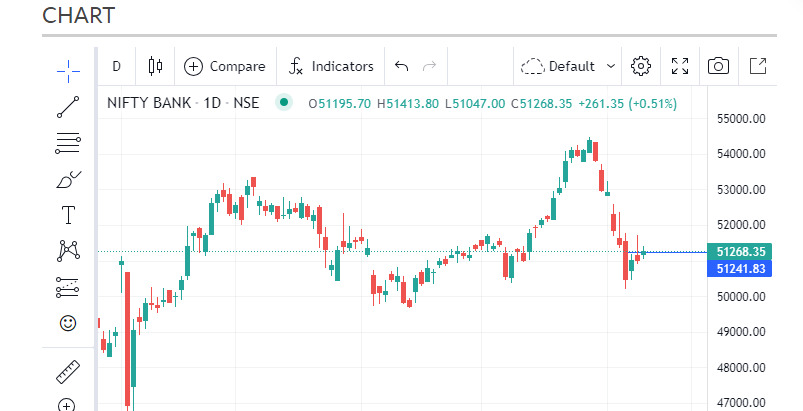

What it does: TradingView is a powerful platform for stock charting and technical analysis. It allows investors to track stock prices, view advanced charts, and analyze financial instruments across global exchanges.

How to use it: Create custom charts using built-in indicators such as moving averages, Bollinger Bands, and Fibonacci retracements. Use these to predict stock price movements and identify trends.

Why it’s great: TradingView has a user-friendly interface and community-driven scripts that allow investors to create and share custom indicators and strategies.

What it does: FINVIZ is a stock screener and market research tool that allows investors to filter stocks based on key metrics like price, volume, and market cap.

How to use it: Use the screener to filter stocks by criteria like P/E ratio, EPS growth, or market cap. You can also monitor insider trading and top gainers/losers to spot opportunities.

Why it’s great: FINVIZ provides a quick overview of the stock market and is perfect for both beginner and advanced investors looking for technical and fundamental data.

What it does: Morningstar provides in-depth research, ratings, and data on stocks, mutual funds, and ETFs. It helps investors analyze the performance of individual companies and funds.

How to use it: Use Morningstar to check stock ratings, understand a company's financial health, and analyze its competitors. It’s an excellent tool for long-term investors focused on fundamental analysis.

Why it’s great: Morningstar offers extensive coverage of stock performance, making it a go-to for value investors seeking deep analysis of stocks and funds.

Looking to save on stock market analysis tools? Check out our exclusive discounts on TradingView, FINVIZ, and Morningstar.

Technical analysis focuses on chart patterns and price movements. Tools like TradingView provide indicators that help identify buying and selling signals. Here’s how to use them:

Fundamental analysis focuses on a company’s financial health and overall market conditions. Morningstar and FINVIZ are perfect for this:

Stock screeners allow you to filter through thousands of stocks to find the ones that meet specific criteria. FINVIZ and Stock Rover offer powerful screeners that let you filter by:

Using stock market analysis tools can significantly improve your investment decisions. Whether you're a beginner looking to learn the basics or an experienced investor seeking detailed financial analysis, tools like TradingView, FINVIZ, and Morningstar provide the data and insights you need to make smarter investments. Start using these tools today, and take control of your financial future by making informed, data-driven investment decisions.

Want to explore more stock analysis tools? Check out our comprehensive list of the best stock market tools.

Lead generation is one of the most important tasks for any startup. It helps your business grow by attracting potential customers interested in your product or service. However, finding the right strategies to generate leads can be challenging, es

In today’s competitive digital landscape, running successful ad campaigns requires more than just creativity. Data-driven decisions are crucial, and that's where ad intelligence tools come in. These tools provide insights into your competito

Animated videos are a powerful tool for telling stories, explaining products, and engaging audiences. Learn how to create stunning animations with the right tools and techniques.